How Artificial Intelligence (and FinTech) Will Help Eradicate Poverty

Artificial Intelligence (AI) is a game changer and will help to improve services for billions around the globe. When combined with FinTech, it has the opportunity to create a real positive change—especially for the impoverished sections of the world’s population. In fact, one of the most impoverished regions in the world—Sub-Saharan Africa, which has a shockingly high poverty rate of 41%—is starting to see real benefit from the introduction of FinTech and AI.

Africa has proven to be a great market for FinTech, especially mobile banking apps, and Sub-Saharan Africa is the only world market where the average rate of mobile banking use is over 10% and several countries have a greater infiltration of mobile banking than bank accounts.

This is where MyBucks is planning to make a major difference. The first partnership of FinTech and an NGO (Opportunity International), the company’s aim is to use FinTech and AI to break the cycle of poverty by using its three brands (GetBucks, GetSure and GetBanked) to increase financial inclusion.

AI is introduced right at the start of the application process. Through AI, MyBucks can quickly and easily determine the potential credit level of its applicants and clients and offer individualized rates based on these levels.

Then MyBucks uses its brands to provide clients with an innovative financial experience. These brands offer clients the ability to easily manage their finances by giving them programs that help them create and manage a budget, detail how much they have in the bank and how much debt they have, provide access to short-term credit or developmental credit (which is credit for life-improving pursuits like agriculture, business and education) and show their insurance coverage.

MyBucks also offers a fantastic incentive to get its clients to become educated in their finances: A discount system based on the clients financial health (with the discount rising with the level of financial health).

The startup is on track for another successful year as revenues continue to increase. This is great news for the un- and underbanked who have yet to enlist its services.

Another partnership aiming to make a positive impact in the Sub-Saharan area is Branch. Based in both San Francisco and Nairobi, the startup uses an application process that analyzes mobile data to determine a client’s credit score and quickly offer loans. With over 75% of Branch’s clients using these loans to run a business, the company is helping the Nairobi economy in numerous ways. And thanks to Branch’s use of AI during the application process, the default rate is quite low.

These startups are using AI to transform the application process and provide financial services to populations that have been underserved for generations and will greatly benefit from the technology. Properly used, they can help billions manage their finances and in turn improve their current situations. It is a great example of the power that exists in smart technology.

How Strong Startups Launch Strong Websites

In today’s digital world, full of savvy consumers who do research before committing to a purchase, if you don’t have a website you’re out of business. For startups aiming to make their impression in a crowded market, the website might be the best way to get the attention of consumers who are constantly inundated with product placement.

When it comes to FinTech companies, a website (that’s mobile compatible) is probably even more imperative. After all, you can’t claim to be a purveyor of modern technology if you aren’t using the technology. If you want the customers you need a website that is going to draw them in and turn them from curious bystanders to loyal fans.

A website that is all splash and no content may look pretty, but it’s not the way to draw in customers. Above all, make sure you pay attention to the site’s usability. Potential customers need to be able to easily interact with the site so they will stay and continue to learn about the business. Consider a text box or a video clip for the front page that lays out your purpose and call to action. Better yet, include satisfied customers in that section so potential customers know you’re not going to ignore your customer base.

If you are new, people are bound to have questions about your services. If they have no way of having these questions answered, they are very likely to no risk their money on your services. Make sure your contact info is easy to find and offer multiple ways for people to reach you (i.e. phone, e-mail, social media).

Social media has in many ways changed how companies interact with their customer base. This is now one of the best ways to promote your services and a great way for customers to get their questions answered. Make sure you have a presence on the major social media networks and make sure these elements connect with each other. Have links to your social media identities clearly placed on the website and use social media to promote new features on the website. In fact, social media is one of the best ways to raise your prominence in the marketplace. Use #hashtags and promoted posts to reach those who are in your target market but are not yet aware of your services.

These three areas are vital when creating a successful website for your FinTech startup and no entrepreneur should overlook them while building the new business.

CommonBond serves as a fantastic example of what a successful startup website should look like. With a clean, easy design and straightforward information, their website provides their market with all the needed information and easy company contact.

There is one other concept that is also incredibly important when building your online identity.

If you want to drive traffic to your site and you want to raise awareness of your services, a simple giveaway or contest is the easiest way to raise your profile. It’s easy to tie the contest to your company and use it to drive traffic. (For example, ask entrants to create a video detailing how your service has changed their banking habits, then put the best videos on the website and ask the general public to vote for the winner.) The potential for free stuff will draw new people to your website and you can use that lure to introduce them to your brand.

Your web presence is one of your strongest promotional venues and any startup that wants to compete in today’s market needs to know how to use the ‘net to reach customers. Put forth a strong web presence and watch as your startup grows.

How Big Banks Govern FinTech Startup Regulations

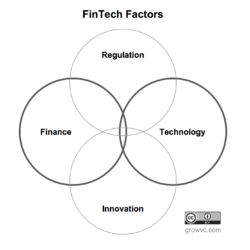

Will 2017 be the year regulation links up with FinTech? This is an issue that has been a matter of business debate for quite some time now, with multiple issues being raised about the effects of regulations on startups. After all, the current regulatory system is complex and convoluted (often even the big banks have trouble following these rules) and smaller businesses can’t function under this weight—not to mention the fact that many regulations were written before the rise of the internet and the global economy, making them out of date.

Will 2017 be the year regulation links up with FinTech? This is an issue that has been a matter of business debate for quite some time now, with multiple issues being raised about the effects of regulations on startups. After all, the current regulatory system is complex and convoluted (often even the big banks have trouble following these rules) and smaller businesses can’t function under this weight—not to mention the fact that many regulations were written before the rise of the internet and the global economy, making them out of date.

To their credit, the business world has been working on the issue. The problem is finding a solution that works for everyone and is an easy transition from the current regulation system yet fits the needs of the new FinTech reality.

Look at the last major regulation passed: The Dodd-Frank Wall Street Reform and Consumer Protection Act. Passed on July 21, 2010, it was designed to fix the major errors that led to the market crash and the rescuing of the Too Big To Fail corporations. By streamlining the regulatory process and improving supervision, the intent was to make regulation easier while keeping a better eye on the market, all in order to prevent another financial disaster.

This bill was written in a market that was not yet experiencing the surge of startups that would come with the change in market and technology. Written to manage and benefit large financial companies, it fails to address and serve the needs of the startups that are currently in the process of changing our financial world. Startups aiming to comply to these regulations suffer in order to meet unattainable demands.

Another major issue arises when FinTech startups—not quite fully confident in the market and unaware of their regulation limitations—get fined for compliance issues. These fines are enough to sink a fledgling company or at the very least damage their reputation in the market.

To be fair, there are cases where FinTech startups are already successfully managing the regulation system. Any of the partnerships done with the big banks will have included regulatory oversight as big banks already have regulatory restrictions to manage.

Regulation as a concept—if done well and done properly—will not hurt FinTech. After all, these laws are set up to protect businesses and keep their employees safe. But what needs to happen is a situation where current regulation is reworked to better help startups grow. There will be pushback against this notion, as big banks serve to benefit by maintaining the status quo, but a government that wants a thriving economy will want to create a business environment that lets all companies prosper. FinTech needs to work with the government to ensure that changes are made to the regulation system and these changes let the sector thrive.

How To Pitch To Venture Capitalists

When we were children we dreamed big and thought that anything and everything was possible. Not everyone lost this belief as they grew up and entrepreneurs are true examples of the ones who still hold tight to the notion that they can achieve their dreams. That being said, every journey is filled with battles that must be won to continue down the road and not everyone makes it. It is a sad and real truth that 90% of FinTech startups fail. The reasons are plentiful: unseen emergencies, lack of understanding of the market, outdone by the competition, etc. However, one of the biggest reasons startups fail is lack of funding. Those money trees we dreamt of as children just aren’t real.

Before you get disheartened and give up on your startup dreams, know this: There are ways to fund your dreams. For startups, one option is venture capitalists. These are the investors who will provide you with the money you need to finance your startup. (You can read more about the VC option here.)

If you want to gain the support from these investors, you will need to create a pitch deck and a pitch presentation that sells the profitable nature your company. This presentation may well be the most important sale you will ever make, so prepare yourself.

The number one most important thing to do is (figure out and) present how your startup is going to change the business world. After all, if the concept is boring and common, the startup itself will slip between the cracks in the market and will not see a profit—which means the venture capitalists will not be willing to risk putting up the capital. Make sure you can quickly and succinctly summarize this argument, as it is the glue that holds the entire pitch together.

Then, lay out how it is going to make money. Here you need to show that you know the market and you know how your startup will recoup its investment (and then some).

Once you have clearly defined these two areas, get to work on the actual presentation. You need to present these facts in a way that entertains and enlightens. Do not expect to rely on cue cards and basic slides. Instead, know the facts and speech enough that you can work off book and create visuals that have a wow factor to draw investors in. Use demonstrations and humor to draw investors to the project in a way that makes them feel comfortable with the situation. Most importantly, make the presentation about the project and the investors—not about you.

When it comes time to approach the potential investors, do not overdo it. Yes, it can be tempting to approach every venture capitalist you can find and pitch to all of them, but it is a much better use of your (and their) time if you do the research and only approach the venture capitalists who have expressed interest in your area of the market. Find the right investors and make sure they know why you are approaching them specifically. Once you have a meeting, give them your well-crafted presentation and be ready to respond to any issues they might have. Do this and your hard work will pay off.

How FinTech and Biometric Authentication Are Changing the World

As technology takes over every aspect of our lives and much of our personal information databases move online, cybersecurity becomes more and more of an issue. The danger is real and growing (cybercrime cost $500 billion in 2015 and that cost will rise to $2 trillion by 2019) and this is becoming a major issue that needs to be addressed. We want the convenience these new systems offer, but we also need to be sure that our information is safe as it moves its way across the web. Solutions are offered (which is why our passwords have changed from PASSWORD and 12345 to WZ48%$90) but so far these stopgaps have shown to be more of an irritation than a final solution.

FinTech knows this and is constantly working on technology that will improve our (financial) lives. The next breakthrough: biometrics. This technology is set to completely change the authentication process, making it much harder for criminals to steal identities and the personal information that comes with them.

Biometric authentication is slowly infiltrating the financial system and will be the main source of identification by 2020. This is good news for FinTech startups that are offering biometric solutions, as they will find themselves set up to offer must-have services to the market at large.

SayPay Technologies, for example, uses its unique technology (Interactive Voice Recognition (IVR)) to provide voice-activated biometric services to its clients. When seeking to complete a financial transaction, users are given a voice token (i.e. a series of numbers) and say the numbers to verify their identity. If the voice signature matches, the transaction is accepted. This system is set to turn the password system on its head and save people from the hassle of having to remember an endless number of nonsense passwords.

Another option is the Nymi Band. This product, worn on the wrist, uses an Always On Authentication system to validate the user’s identity through a heartbeat identification system (HeartID) or a fingerprint identification system (Touch ID). As well, as it incorporates the FIDO Universal Second Factor system, it can be used to authenticate compatible services. In essence, the Nymi Band replaces car keys, door keys, even PINs. No longer do users have to worry about theft, as all identification is directly tied to their unique body traits.

These startups show just how amazing FinTech advancements are making our world. After all, technology is a double-edged sword, bringing with it both convenience and new levels of crime and cybercrime, and we need new systems to keep our lives safe from these various dangers. Biometric authentication is making security easier for everyone involved and FinTech is embracing this technology.

The New Wave of Banking

When it first started gaining traction, FinTech was seen as a revolution that would overturn the status quo. Startups were using the technology to create fantastic new products and services and the logic was that this would bring about a brand new financial market (and RIP big banks).

Now that FinTech’s importance is better understood and the initial flurry of excitement is subsiding, something more interesting is emerging. Rather than battling its newer (and improved) financial counterparts or choosing to simply fade into history, the big banks are reaching out and partnering with these FinTech startups in order to bring banking into the next generation.

Take Regions Bank and Avant, for example. In this case, Avant was brought on board to provide Regions Bank’s customers with a new consumer loan process. A true partnership, the new service carries both companies’ names (“Regions Powered By Avant”) and gives Regions customers an upgraded digital service while giving Avant more prominence in the marketplace.

It’s not just partnerships that are bringing the two sides together. The bigger financial institutions are also using investment and acquisition to bring FinTech startups and the new advancements into their fold. In fact, 30% of banks are considering the acquisition of FinTech startups.

Capital One, for example, has acquired several FinTech startups. Its most recent acquisition was Paribus—an app designed to alert users when a product they’d purchased had reduced in price—adding the money-saving feature to its list of offerings.

Who wins in this situation? Well, collaborating with FinTech startups allows the big banks to save money, increase their revenue and rebrand their image; meanwhile, startups are given needed capital and access to a much larger market.

The biggest winners in this new partnership may just be those previously labelled unbankable. By partnering with startups, big banks are increasing the prominence and availability of FinTech’s needed improvements like bitcoins and digital and mobile payments, which in turn is making it easier for billions to access these technologies.

The 2017 financial market will be full of interesting new developments as these partnerships and M&As continue the overhaul of the banking industry.

How to Market My Startup

Should you launch a FinTech startup? Well, FinTech is a global movement and startups are increasing in popularity. (In fact, the Canadian federal government recently announced plans to increase the amount of money it invests to adopt more Canadian startup technology.)

If you decide to enter the market (or already have entered the market), make sure you don’t ignore the importance of marketing. After all, if your product is not properly put in front of potential customers, there is little chance they will decide to buy it.

The first thing to decide when organizing your marketing plan is what element of the company you are going to feature. By putting the strongest element up front, you present the company in the best way to potential customers. And yes, you do need to decide on a focus point. If you run a campaign that rushes over all your great features you run the risk of massively diluting the strength of these features. Are you the first company to feature a new service, like Overbond and the bond market? Put that up front and use that to bring in customers so they can learn about your other amazing features.

Another thing to consider is your social media campaign. The social media market is incredibly important in today’s world. (According to Hubspot, 92% of marketers considered social media to be an important tool for growing business.) After all, social media is a cheap way to interact with your current customers and gain new ones, all while increasing your brand recognition and customer loyalty, not to mention your SEO. If it comes down to choice, focus on social media instead of your outbound marketing.

Of course, content is probably the most important element. A badly-written marketing campaign will turn people away before they can even learn about what your company is offering. Hire quality writers and use them to produce content marketing that will draw in interested parties who will in turn become customers. Use this angle to further push what makes your company amazing. Wealthsimple, for example, has used magazine articles and children’s books to creatively promote its services and impress its image on consumers.

The right marketing plan will push your company and product ahead of the pack and give you the promotion you need to increase your customer base. In today’s market, where online streaming and ad-skipping technology mean television advertising is no longer the force it once was, startups need to have solid plans in place in order to best reach their customers.

Where Will the Next FinTech Hub Be?

The world is ever changing and the business world is no exception. With a great interest in the FinTech field, I am fascinated by the question of who will win the title of the next FinTech hub.

Previous holders of the crown have been San Francisco, New York and London. But with the changing market and a growing interest in the FinTech field, more and more places are campaigning to take the title. Let’s look at some of the front runners.

Paris, the city of lights, has been doing major work to become the city of FinTech. It has the bonus of being the city that London entrepreneurs are moving to post-Brexit, which gives it a solid base of companies on which to build its empire. On January 25-26, 2017, Paris hosted the first Paris Fintech Forum, bringing together thousands of FinTech startup owners and entrepreneurs to discuss the business of FinTech. By working up this strong base, Paris has a real chance to take over the FinTech market.

Then there is China, a powerhouse country that is aiming to take the FinTech world by storm. A recent report by DBS and EY ranked China at the top of the list of FinTech hubs and their investment in FinTech has doubled since 2010. In fact, the country has launched a $1.5 billion investment fund designed to help cultivate FinTech companies. With such a strong backing, the FinTech companies coming out of China will easily help push China as the ideal hub.

The underdog is likely the city of Visakhapatnam. That being said, the recent demonetization of Indian currency has increased the interest of FinTech in the country and the Indian government is seeking to cultivate this interest by organizing roadshows and creating needed partnerships. As FinTech will bring banking to a large number of Indian citizens who were previously unbankable, Visakhapatnam has the compelling backstory to possibly overtake the competing cities.

Of course, country pride means I have to put my money on Toronto. Already a major player in the financial industry and home to many FinTech startups making fantastic strides in the international market, Toronto is very attractive to foreign investors and foreign talent. With the right push, the city could easily become the next FinTech hub and take banking to the next level.

Who will be next to take the FinTech crown? We have to wait and see.