It’s Time for a Universal Basic Income

As costs rise while wages stagnate (and income inequality grows), the concept of a universal basic income (UBI) is starting to gain real traction. The simple notion of giving every person a set amount of money to help meet their basic needs could dramatically reduce poverty (as well as the stigma of being on the dole) and fuel innovation by giving people funds they can use to pursue dream projects. Technologically we are at a point where we can easily distribute the payments and, as machines continue to take over more of our jobs, we need to seriously consider how we are going to functionally survive in the post-work world.

Many economists are stressing the incredible positive effects UBI could have. John McArthur, for example, stresses that it could help millions and millions of people and eradicate extreme poverty in 66+ countries, while Thomas Piketty calls it “a key building block in the reorganisation of our social model” and Christopher Pissarides, a Nobel-prize-winning economist, sees it as a way to fix the flaws in the modern market. Creating a world where people aren’t necessarily dependent on employment to survive has the real opportunity to eradicate unsafe working conditions and amend the reasons why we seek out work.

Major names are picking up on the idea of UBI. Governments are seeing it as a fix to a complicated, controversial and inefficient welfare system and Silicon Valley is pushing it as a solution to the increasing automation and machination of jobs. Next year, in fact, a Facebook-funded initiative (run by the Economic Security Project) will be testing the concept by giving a sampling of residents from Stockton, California $500 a month. This initiative, the Stockton Economic Empowerment Demonstration (SEED), will help to make a real positive impact by shifting the profits from a very wealthy corporation to one of the poorer areas of the state. This is an example of the shift we should be making, spreading the benefits of privilege to a greater percentage of the population.

On a national level, Finland has been running a UBI test project that sees 2000 residents receive $645 a month for two years. Kenya, through GiveDirectly (Givedirectly.org), has been providing cash transfers of $22 since October 2016 and will continue the pilot for the next 12 years. Canada is working on setting up a test group in three cities in Ontario, with a select group of individuals in Hamilton, Lindsay and Thunder Bay receiving $16,989 a year ($24,027 for a couple) for up to three years. These experiments will serve as a great base point to highlight the need for and benefits of basic income and pinpoint where changes need to be made to better serve the general population.

Supporters of the UBI program are stressing the positive effects the test projects are having on employment rates, as recipients can pursue work without the fear of clawback (as is the case with welfare programs), while recipients are excited about the potential the extra money brings for their entrepreneurial pursuits and speak of the improvement in their quality of life. Humanity has long sought to eradicate poverty and the ills that come with poverty and the basic income program has real potential when it comes to finally finding the solution. It really is a simple way to create a better human economy and a better world.

How Basic Income Will Change Our Economy

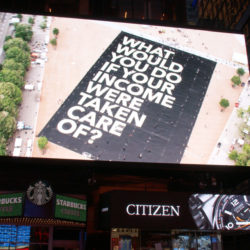

Humans are dreamers. We have aspirations of greatness and know (with a bit of a leg up) we could help better the world. As technology changes how we work and play, we have more of an opportunity to explore what we could potentially do. The primary problem we encounter though is quite simple: We live in a capitalist society and need money to survive. Is there a solve?

Enter the universal basic income.

The idea of universal basic income (UBI) has been debated for an incredibly long time and is now starting to gain real traction. Governments in Canada and Finland are currently exploring its potential and top economists have stressed its positive effects. Much has been said about how it could reduce poverty, and previous test runs have shown that it has also improved health rates (both mental and physical), but there are other positive elements it would bring with it.

With a bit of extra cash flow, so many people with dreams of entrepreneurship could start the journey and make a real positive impact on the business world.

Many of the top entrepreneurs know this and are pushing UBI as the best way to feed innovation. Some are even testing the benefits themselves. Y Combinator (a U.S. startup incubator) is set to run an experiment to explore the impact of UBI. Should the results meet expectations, recipients will have the opportunity and ability to pursue their dreams and help discover a better world. Think about it: So many major problems could be solved when our great minds have more time and energy to explore them.

Once UBI does come into play FinTech will have a very important role. The large-scale dispersal of funds will require an automatic payment rollout and that recipients have access to financial services. Who better to meet the varying banking needs of society than FinTech? Its services will ensure that the greatest number of people will be able to access the benefits of the UBI system in a secure way.

I for one am excited by what a UBI future has in store for us. The extra capital will improve our economy and help bring forth new innovations that will lead us into the next stage of our evolution. Imagine how great that will be.

How FinTech Will Solve Income Inequality

We know income inequality is not good. It damages people’s lives and hurts the economy. History is full of rebellion against it, whether by attempting to overthrow the monarchy or throwing tea overboard. Sadly this evil has yet to be defeated. In fact, it has only grown. It’s also been self-perpetuating, as the money has stayed in the same classes and the lower social rungs have had a near impossible battle to improve their situation. They can try, but big banking is rigged to favor the upper classes.

The good news? A revolution is here and FinTech is set to wage war on income inequality. Tune in this week as we explore the three ways FinTech will defeat income inequality.

The first way to defeat income inequality is to bring financial services to the sizeable portion of the world that was and is overlooked by big banking. Prior to FinTech billions of people around the world were seen as not viable customers by the monoliths and had to cobble out financial services from secondary and questionable providers that have exploited their poverty and need…if they could get anything. Thanks to mobile banking services offered by FinTech, these underserved people finally have a secure place to store their money, letting them properly manage it and accumulate interest.

Establishing a successful business is a great way to ensure economic stability and when seeking to start a business FinTech can be a lifesaver. Take Kabbage for example. This company aims to make accessing funding for small businesses a much easier process, offering an app for quick funding. Then, once the loan has been received, Kabbage’s system offers easy repayment plans like autopay and consolidated payments, reducing the amount of stress and worry entrepreneurs need to shoulder. By remaking the loan process, FinTech is opening up the business world to people previously shut out of it.

FinTech offers options for those who choose to use savings to fund a startup. The FinTech system allows users to slowly and automatically moving small amounts of money over, letting aspiring entrepreneurs build a nest egg in manageable increments and set up deposit systems. By providing a better way for entrepreneurs to save for their businesses (and lowering the need for credit), FinTech is feeding a healthier economy. Now imagine what this will mean when basic income is introduced. Social justice entrepreneurs—regardless of their financial background—will more easily be able to build a nest egg to fund their startups, helping to remake the financial marketplace and further reduce income inequality.

A lack of financial access is a major issue that can see people trapped in a financial hole, unable to fulfill their entrepreneurial dreams. When combined with a financial system rigged to benefit the elite, it can be an epic battle with little hope for those wanting a way out. The good news is that FinTech and innovative entrepreneurs are ready to attack the problem at its source and help people get access to the funding they need to become active contributors to the economy. By evening out the playing field, FinTech has the amazing and unique opportunity to repair or reduce income inequality, a reality we should all want to see come to life.