Do You Know About the FinTech Sandbox?

Good news, FinTech startup enthusiasts: It’s time to start playing in the sandbox again. Of course, the adult version is different from the sandbox of your childhood. This new sandbox is a regulatory sandbox (or, as Charles Sousa called it during his Toronto Region Board of Trade speech, “regulatory super sandbox”) and is set to improve our FinTech market. Entrepreneurs get to play in a controlled environment (with proper supervision) and can use this setup to explore the potential of their startup idea. Governments across the globe are setting up sandbox initiatives in an attempt to grow their FinTech industries and move towards becoming a FinTech hub. This week we will be looking at these sandboxes.

Home to the business capital of Canada, it’s easy to see why Ontario is aiming to be the next FinTech hotspot. Government and business initiatives are being put into place to create a thriving FinTech market. By loosening regulations and introducing the Ontario FinTech Accelerator Office, Ontario is hoping to increase innovation and the presence of startups in both local and international markets. Participants test and fine-tune their startup concept, then get feedback from customers and use that to further improve their startup. Entrepreneurs exploring the brave new world of FinTech should keep an eye on this, as it is vital for those hoping to conquer the FinTech market.

Ontario’s regulatory sandbox is not an unchartered or unique initiative. Multiple countries have used this model in order to help bring forth innovation and foster a stronger business hub. First let’s look at the western hemisphere.

The UK Financial Conduit Authority was one of the first agencies to spearhead a regulatory sandbox and have been running cohorts for a few years. These sandboxes have proven to be highly successful, with attending entrepreneurs showing business growth and improvement. In fact, 90% of the participants in the first year proceeded to a market launch and 40% received investments because of the sandbox testing. It’s easy to see why this sandbox has been seen as a model for other countries.

Last year Switzerland set out to explore the effects of special licensing and reduced capital requirements for FinTech startups, hoping such an endeavor would make the country home to a FinTech hub. In their sandbox, FinTech startups were allowed to accept up to 1 million Swiss francs before regulation would be introduced. Thanks to this initiative, cryptocurrency startups are flocking to the country and its Crypto Valley.

As these hubs are close to North America, their breakthroughs would have a quick impact on our technology. For this reason, they should be watched with interest. However, FinTech sandboxes are not limited to this hemisphere.

Home to billions of people and three of the top five tech cities in the world, the eastern hemisphere’s contribution to technology cannot be overlooked. Many major cities in Asia have used sandboxes or are in the process of setting them up.

The Abu Dhabi Global Market, for example, runs a sandbox it calls the Regulatory Laboratory (RegLab). Currently on its second cohort (which includes the Canadian firm Remitr), the program had a promising first cycle and is set to expand when it moves into the new Fintech Innovation Centre in 2018.

Thailand (through the Bank of Thailand) set up a sandbox this year to improve the services offered in the country, while Singapore (through the Monetary Authority of Singapore) set up a sandbox to allow more experimentation and innovation in FinTech, purposely positioning itself as the place to grow the next breakthrough in the FinTech field. It will be interesting to see the new innovations and developments that come from these sandbox initiatives.

Japan is currently exploring the potential of the regulatory sandbox, and Prime Minister Shinzo Abe has stated that they are moving forward with a plan to minimize the regulation level imposed on FinTech startups. Considering how technologically savvy Japan has been in the past, this sandbox will likely bring forth amazing new concepts.

The whole world is looking at FinTech and everywhere wants to be the centre of the action. Although this has the potential to create an environment of hostility, it is actually bringing forth amazing collaborative think tanks. FinTech sandboxes are a fantastic way for entrepreneurs to explore how to improve their FinTech concept. Keep an eye on these sandboxes, as they are where the next big technological breakthrough will be cultivated.

Get Ready for the Blockchain and Cryptocurrency Revolution

Cryptocurrency is a major buzzword right now, thanks in large part to bitcoin’s continuing (albeit tumultuous) rise in the markets and the ever fluctuating world currencies. As technology continues to take more of a hold on our daily lives, the importance and presence of cryptocurrency will continue to grow. Closely linked to cryptocurrency, blockchain is also growing as a real market presence. Blockchain is already making an impact and will see incredible gains in 2018, with multiple international conferences set to bring experts together to explore its full potential and financial strongholds like Wall Street aiming to adopt the technology. Smart entrepreneurs know this and are exploring the newest innovations in order to revolutionize the blockchain and cryptocurrency marketplace. Although the market is crowded, the innovative startups find a way to stand out.

How do you attract customers in a busy marketplace? You bring them in with something you know they will like. It’s been established that people like rewards. They also (generally) like technology and money. Combine them together and you’ve got a winner. Giftz realized this and is now set to offer its own cryptocurrency (itCoin) as a reward program for partnering businesses. This is great news for businesses, as they now have an easy way to offer and manage a rewards system that (until now) was often confusing and complicated. Considering how popular reward programs are, it’s pretty easy to see that the itCoin will be a win for everyone.

Of course, some businesses know the best way to reach your audience is to make your product simple and easy to understand. Ziftr set out to provide an easy solution by making its cryptocurrency (ziftrCOIN) at minimum match the USD and has a shopping cart system set up for an easy shopping experience. As well, the company has established a solid relationship with retailers, increasing the number of places the cryptocurrency can be used. Now partnered with GoCoin, the ziftrCOIN has a real chance to find a place in people’s digital wallets.

With so many (big and little) names seeing the potential in cryptocurrency, a company that can create the tokens for other startups is in a very good place if they choose to offer their services. This is what Simple Token is setting out to do. The company offers people the chance to buy Simple Tokens and use this technology to power branded cryptocurrencies for their businesses. On November 14 the company held an initial sale of their Simple Tokens, letting people in to test the waters before the official 2018 launch of the platform. Watch for them next year, as their services will likely be in hot demand.

The power team of blockchain and cryptocurrency will make a big impact as 2017 draws to a close and will continue to revolutionize our relationship with money as we make our way through 2018. The amazing thing about it is the opportunity it brings, as these new cryptocurrencies offer benefits typical currency never has. Technology has changed our relationship to so many aspects of our lives, and now it is finally time for it to take our currency to the next level.

How Women Are Funding FinTech

Although the gender gap still exists in the business world, recent years have seen more women coming to the forefront. The world over, women are getting ready to put on their entrepreneur hats and conquer the marketplace. But a simple truth remains: Starting and maintaining a business requires capital. How does the modern businesswoman find funding for the modern FinTech business? Well, there are options and that’s what we will look at this week.

Any business owner will likely have to explore the option of the business loan, and this is a viable option. There are even companies that specifically offer business loans for female entrepreneurs. Kabbage, for example, recognizes the difficulty women often face in the business world and have tailored a loan process to better meet their needs. As well, there are government agencies and nonprofit organizations that offers grants to entrepreneurs (for example the InnovateHER Challenge) and these can definitely help get the business going. A good mix of grants and loans can be the best route to successfully launching your business.

Venture capitalists are one of the major ways entrepreneurs fund their businesses. That being said, studies show that, when looking for support from venture capitalists, women have a tougher time. In fact, according to Fortune Magazine female entrepreneurs receive about 2% of venture capital funding. This is an area where the effects of the gender gap are quite evident: Female venture capitalists are more likely to invest in female entrepreneurs, but over 90% of venture capitalists are male (source: New York Times). For women seeking venture capital to fund their entrepreneurial aspirations, it’s a tough and uphill battle.

When it comes to funding sources, where women have been shown to succeed is in the field of crowdfunding. In fact, studies show that crowdfunding projects led by women both collect more money and are more likely to reach their targets. What does this mean? Women seeking funding for their enterprises should make sure they explore the crowdfunding option. The options are plentiful by this point and there are even crowdfunding platforms specifically designed for businesswomen. Collectives such as iFundWomen and Women You Should Fund give entrepreneurs a set audience to pitch to, expanding their exposure and their chance of finding backers.

Women across the globe are setting out to conquer the business world. This is incredibly important, as the female voice is needed in the boardroom and the marketplace. Sadly, starting and running a business requires capital and any women hoping to join the list of successful entrepreneurs need to know the best places to find funding. The good news is that the modern financial world offers options to aspiring entrepreneurs. Know the best places to look and your business will be on the right path to success.

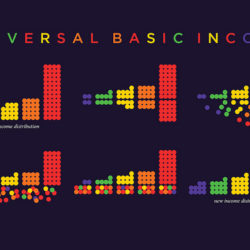

3 Reasons Why You Shouldn’t Fear UBI

Universal Basic Income is (becoming) a hot topic and major institutions are seriously exploring its potential. This is important, as the increasing automatization of jobs means the work world will look very different in the future. Although many top economists have stressed the positive impact it would have on society and our economy, misconceptions mean many people see UBI as a ridiculous and unfeasible pipe dream. This week I will be looking at three of the major arguments against UBI and showing why they should not dissuade us from exploring this initiative.

UBI Fear #1: “It’ll be too expensive!”

Yes, there is a definite cost involved in introducing UBI. The important thing to remember, however, is said cost will be returned to the local economy, helping it to grow and remain healthy. UBI has also been shown to improve overall health rates, and this in turn could lower our healthcare costs. Also, considering we (via the government) are already subsiding major corporations, investing in ourselves should not be such a negative concept. UBI has the potential to improve the lives of millions of people and that is worth the investment.

UBI Fear #2: “UBI would lead to inflation, rendering the benefits moot!”

As long as the system is set up properly, this will not happen. In a government-funded system, the adoption of a basic income initiative does not mean that governments will instantly start printing vast amounts of extra money to meet demands, thus causing massive inflation. Instead, the money used to fund the system is money that is currently part of the economy, just requisitioned from other areas. Also, the base money given by UBI is not so generous that it will drastically change people’s spending habits, it’s just that a percentage of the purchasing money is (potentially) coming from a different source. Supply and demand will remain relatively constant, limiting the risk of inflation.

UBI Fear #3: “People will just stop working and do nothing all day!”

Previous basic income experiments have disproved this logic. In fact, basic income increases entrepreneurship and can actually improve employment rates. When Namibia introduced UBI unemployment rates decreased from 60% to 45% and a UBI pilot project in India saw increased employment and entrepreneurship rates. Think of it this way: Giving people a solid financial base reduces stress and anxiety and improves overall emotional and health rates, making them better employees. Plus, UBI can offer people the opportunity to pursue further education, making them more skilled workers. As well, UBI will compensate the many people doing unpaid labour like childcare, senior care and housework. The workplace of tomorrow will not suffer from the introduction of UBI. Instead, it will undergo a needed renovation and emerge healthier than ever.

A socially-conscious society should be doing what it can to ensure the health and well-being of its people and a universal basic income is the best way to do just this. By giving people a solid financial base we can reduce poverty and improve the health and well-being of the general population. Technologically-speaking we are at the point where we need to remake the work world, as technological innovation has changed how we create and manage so many things, and UBI will help us survive and thrive as we adapt to the next stage of employment. For the good of humanity, it’s time we introduced a basic income.